Financial Fusion lifetime deals let you manage business finance with one simple payment. No more monthly fees. The tool offers profit and loss reports, balance sheets, and clear dashboards. It connects with QuickBooks, Xero, and Google Sheets for smooth data flow. Small businesses, freelancers, and agencies can save big. Lower tiers cover one company, while higher tiers allow multiple. Most deals include future updates and a 60-day refund policy. Subscriptions often cost $600–$1200 yearly. With lifetime access starting at $29, savings reach over 90%. Many users praise its simple design and clear insights. For long-term use, Financial Fusion lifetime deals bring peace of mind, easy reporting, and lasting value.

What is Financial Fusion?

Financial Fusion is a modern finance management tool that helps businesses track money with ease. It creates profit and loss statements, balance sheets, and cash flow reports in simple dashboards. The software connects with QuickBooks, Xero, and Google Sheets, making data import smooth. Small businesses and freelancers use it to cut manual work and gain clear insights. Agencies and startups like its ability to manage multiple companies. Financial Fusion focuses on clarity, showing trends and highlighting errors quickly. Reports can be exported or shared with accountants. By reducing subscription costs through lifetime deals, it offers long-term savings. For anyone needing accurate financial reports, Financial Fusion provides a simple, affordable, and effective way to stay in control of business finances.

👍Get Financial Fusion Lifetime Access!

What Does the Financial Fusion Lifetime Deal Include?

You pay once. You get access for life. No more renewal needed. That is the main draw.

-

One-Time Payment, Lifetime Access

You pay once. You get access for life. No monthly or yearly fees. -

Intelligent Financial Insights (AI-Powered Analytics)

Tool gives you analytics and insights with help of AI. You see trends, spotting costs, profit margins, oddities in data. -

Customizable Reporting

You can shape reports. Choose which metrics to see. Profit & loss, balance sheets, monthly or yearly reports. -

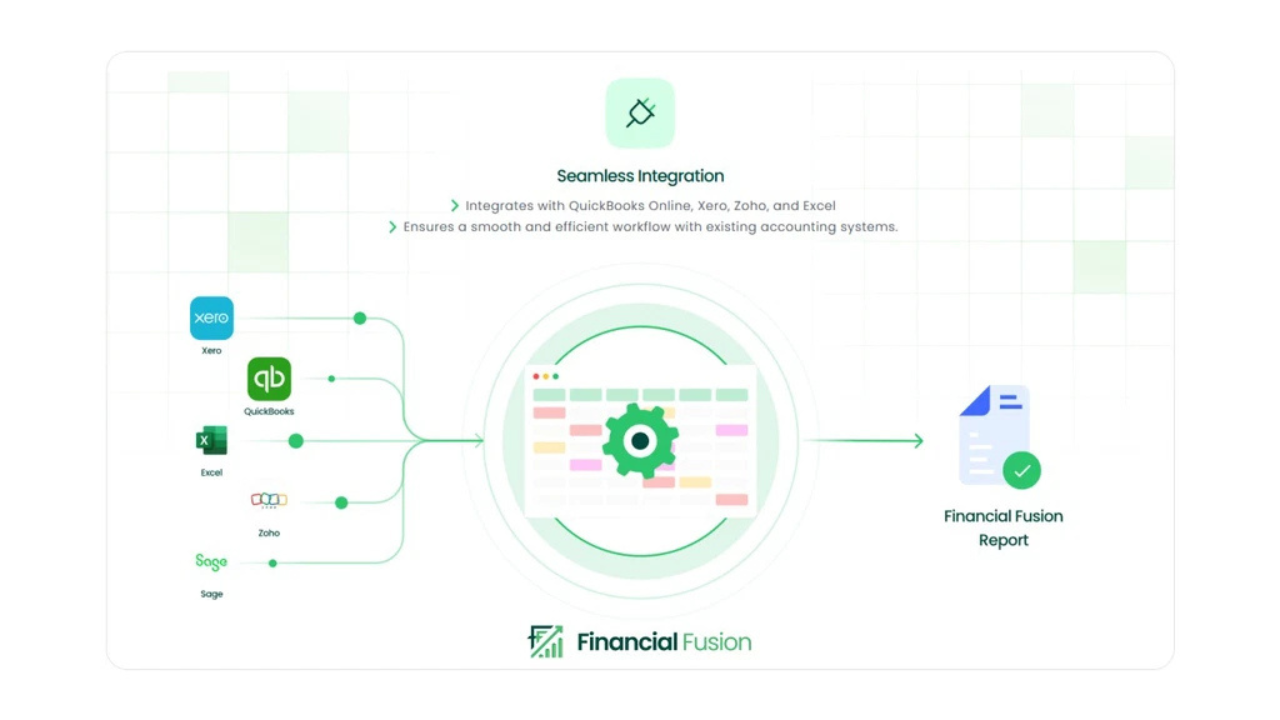

Seamless Integrations

Connects with popular tools like QuickBooks, Xero, Excel, Google Sheets. Data flows easier. Less manual work. -

Multiple Tiers / License Levels

Different plans depending on needs. For example:-

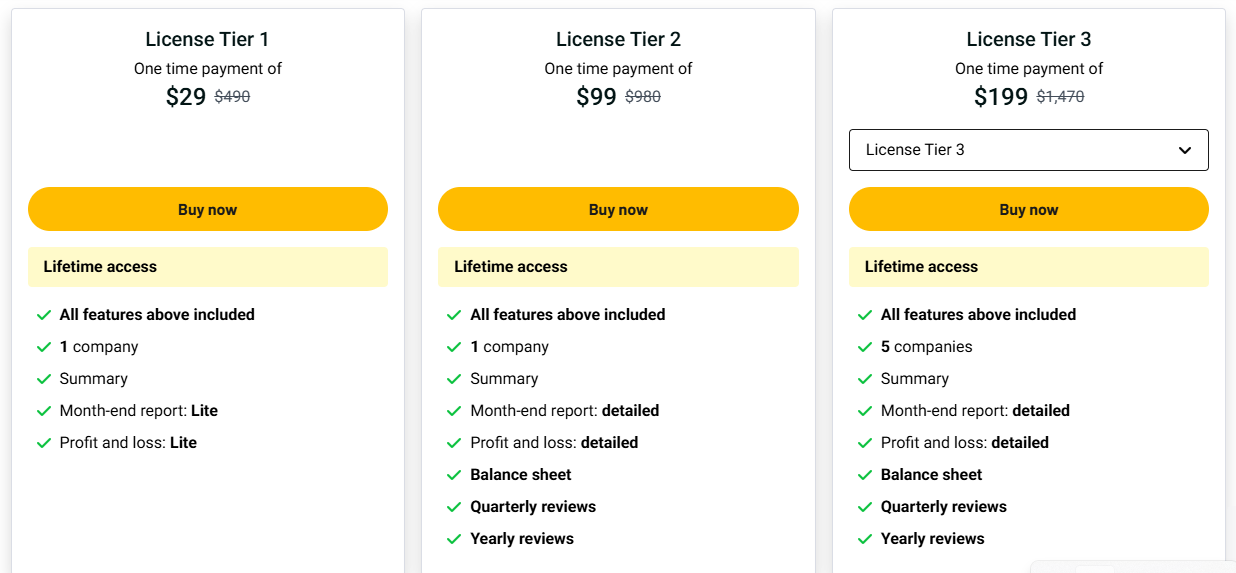

Tier 1 (~$29) for basic reports, one company.

-

Tier 2 (~$99) adds more detailed reports (balance sheet, quarterly/yearly) for one company.

-

Tier 3 (~$199) supports several companies (e.g. 5) and full features.

-

-

Future Feature Roadmap

Some features are coming. For example cash flow tools, “AI CFO” tools, better integrations (including with Wave), un-branded reporting, etc. -

Real-time Updates / Syncing

Data updates fast. When transactions happen, dashboards or reports reflect them as soon as possible. -

User Support & Refund Policy

Support included. Also many deals offer a money-back guarantee (for example 60 days) if tool doesn’t meet expectations.

🎯 Benefits of Choosing a Lifetime Deal

-

One-Time Payment: Pay once, avoid recurring subscription fees.

-

Long-Term Savings: Keep costs low compared to yearly or monthly plans.

-

Peace of Mind: No surprise price hikes or hidden charges.

-

Lifetime Updates: Many deals include future features without extra cost.

-

Easy Budgeting: Know your expenses upfront, plan finances better.

-

Scales with Growth: Higher tiers often support more users or companies.

-

Refund Options: Most deals offer 30–60 day money-back guarantees.

📝 Things to Check Before Buying

-

Feature Limits: Some tiers restrict companies, reports, or integrations.

-

Upgrade Policy: Confirm if future features are included in your plan.

-

Integrations: Check if it works with your current tools (QuickBooks, Xero, Sheets).

-

Support Quality: Ensure responsive customer service is available.

-

Ease of Setup: Importing old data may take time or effort.

-

Refund Terms: Look for a 30–60 day money-back guarantee.

-

Roadmap: Review upcoming features and confirm they meet your needs.

📊 Stats & Numbers to Know

-

Financial Fusion’s Tier 1 plan is priced at $29, down from about $490. That means you save ~94% compared to regular cost.

-

Tier 2 costs $99 (one-time), previously priced near $980.

-

Tier 3 covers up to 5 companies, offered at $199 instead of ~$1,470 in full-price model.

-

The deal comes with a 60-day money-back guarantee so users can test risk-free.

-

Global SaaS market size was about $317.55 billion in 2024, expected to grow to over $908 billion by 2030. CAGR ~18.7%.

-

SaaS revenue growth is expected at ~19.38% annual growth between 2025-2029.

-

More than 80% of companies will use AI-enabled apps in their systems by 2026 (up from ~5% in 2023).

Who Benefits Most From Financial Fusion Lifetime Deals

These users can get highest value:

| User Type | How They Benefit |

|---|---|

| Small business owner | Avoid recurring payments; get clear reports; one-time cost helps cash flow. |

| Freelancer / Solo entrepreneur | Need basic finance clarity; avoid complex accounting tools. |

| Growth stage startups | Use higher tiers later as business scales; internal financial planning. |

| Consultants / agencies with multiple clients | Multi-company capacity of Tier 3 helps manage more than one business. |

| Anyone tired of monthly fees | Lifetime deal frees them from subscription fatigue. |

⚠ Possible Drawbacks of Financial Fusion Lifetime Deal

-

Some Features Still in Development

Users note cash flow tracking and “AI CFO” tools aren’t fully ready. Lower tiers may miss them. -

Feature Limits in Lower Plans

Basic reporting or fewer metrics come with cheaper tiers. For advanced reports or many companies, you pay more. -

Initial Payment Can Be Hard for Some

Even though deals are discounted, upfront cost may still be large for small startups. Budget may not allow it. -

Support Might Lag

As more lifetime users join, response times or support resources might stretch thin. Some reviews say support is slower or limited. -

Upgrade / Promise Uncertainty

If future features are promised, there might be delays. Risk that some promised features might not arrive in all tiers. -

Dependence on the Company Staying Strong

If the maker stops developing or shuts down, lifetime deal users may lose value: support, updates, compatibility. -

Limited Flexibility

If your needs change (more complexity, more integrations), the tool might not scale well. Switching to other tools can be hard. -

Learning Curve on Advanced and AI Features

Users with low technical or financial background may need time to understand advanced analytics. Some want training or support.

Comparison with Competing Tools

Here’s how Financial Fusion lifetime deal stacks up.

| Tool | Cost Per Year (Estimate) | What You Get | Financial Fusion Lifetime Deal |

|---|---|---|---|

| Tool A (subscription) | $50-100/month = $600-1,200/year | All features, monthly billing | One-time $29-199 (depending on tier) |

| Tool B | $70/month = $840/year | Multi-company, reports etc. | Same as above |

| Financial Fusion | Only one payment; no renewals | Reports, AI insights, integrations | Much cheaper after first year |

So, by year two or three, you already saved more with lifetime deal.

Quote from an Expert

Here’s a quote from an expert about financial clarity and reporting, which applies well to tools like Financial Fusion:

Having clear financial visibility isn’t just about knowing your bottom line—it’s about understanding the metrics that drive business decisions and create enterprise value.

— Franck Saragossi, EOS Worldwide

If you want, I can find a quote specifically about lifetime deals or SaaS pricing to match your content more closely.

🔍 Recent Trends & Statistics

-

Global SaaS spending is growing fast. Gartner estimates $299 billion in end-user spend for SaaS in 2025, about 19.2% growth over 2024.

-

SaaS has become the major part of public cloud services. In 2023, the SaaS segment made up nearly two-thirds of the public cloud market revenue.

-

Automation & AI are now core in finance tools. For example, firms expect automated invoicing software to more than double in spending from $850 million in 2020 to $1.9 billion by 2025.

-

Many companies use many SaaS apps. Organizations on average use around 112 SaaS tools currently. That number dropped slightly (down ~14%) from previous year as firms clean up overlapping tools.

-

Most SaaS businesses track customer lifetime value (CLTV). About 62% of SaaS companies say CLTV is one of their key metrics.

-

Churn (loss of customers) remains important: the average annual churn rate is around 5.2% for many SaaS firms. That means keeping users matters a lot.

❓ FAQ: Financial Fusion Lifetime Deals

1. What is Financial Fusion?

Financial Fusion is a finance tool that gives profit and loss reports, balance sheets, and cash flow statements in simple dashboards.

2. What does the lifetime deal mean?

It means you pay once and get lifetime access, without monthly or yearly fees.

3. Are updates included in the lifetime deal?

Yes. Most offers include product updates at no extra cost.

4. Can I manage more than one company?

Yes. Higher tiers support multiple companies, while lower tiers cover one.

5. Is there a refund policy?

Yes. Most deals include a 60-day money-back guarantee, so you can try risk-free.

6. Who benefits most from the deal?

Small businesses, freelancers, startups, and agencies that need clear reports regularly.

7. Does it integrate with other tools?

Yes. It works with QuickBooks, Xero, Excel, and Google Sheets.

8. What are the possible drawbacks?

Lower tiers may limit features. Some advanced tools are still in development.

9. How much can I save with the lifetime deal?

You can save up to 90% compared to normal yearly subscription prices.

🏁 Final Thoughts

Financial Fusion lifetime deals bring strong value for businesses and freelancers who want simple, affordable finance reporting. A one-time payment removes the stress of rising subscription costs. Features like profit and loss reports, balance sheets, and AI-driven insights make daily financial tasks easier. Integrations with QuickBooks, Xero, and Google Sheets improve workflow. While lower tiers have limits and some advanced features are still coming, the savings are clear. For long-term users, this deal offers peace of mind, reliable updates, and real control over business finance.