Invoiless

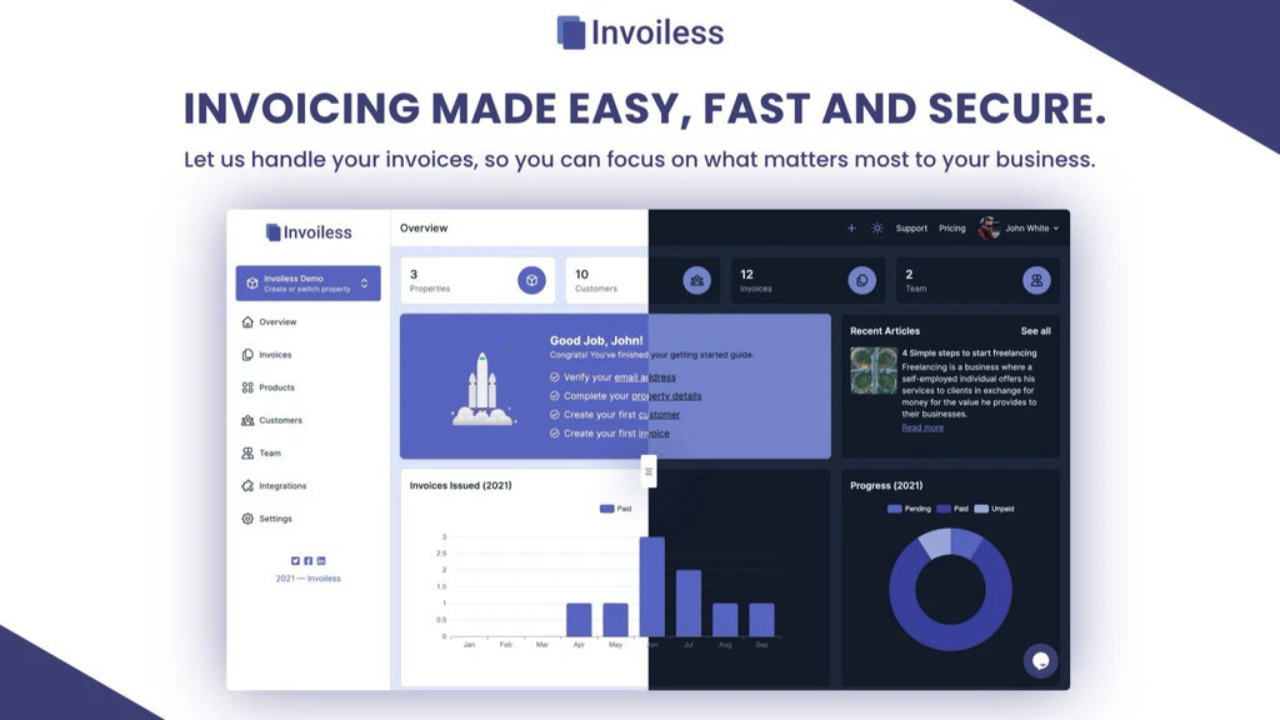

Simplify Your Invoicing Tasks with Our All-in-One Invoicing Solution

$69

Invoiless Review: Key Features, Pros, and Cons Explained

Invoicing is a crucial part of running a business. A reliable invoicing tool can save time, prevent mistakes, and ensure smooth cash flow. One such tool is Invoiless, a simple and effective invoicing software. But is it really the right choice for your business? In this review, we’ll break down the features, benefits, and drawbacks of Invoiless Review to help you make an informed decision.

What is Invoiless?

Invoiless is an easy-to-use invoicing software designed for small businesses, freelancers, and entrepreneurs. With its simple interface and user-friendly features, Invoiless allows users to create, manage, and send invoices in just a few clicks.

The software supports various invoice templates, tracks payments, and offers essential features such as client management, customizable branding, and recurring invoices.

Key Features of Invoiless

Here are the key features that set Invoiless apart from other invoicing tools:

-

Easy Invoicing: Invoiless lets you create professional invoices quickly and easily with customizable templates.

-

Automated Reminders: Set up automatic reminders for unpaid invoices to ensure timely payments.

-

Recurring Invoices: Ideal for businesses with subscription-based services, this feature allows you to set up recurring invoices for regular clients.

-

Multi-Currency Support: Invoiless supports multiple currencies, making it a good choice for businesses with international clients.

-

Client Management: Keep track of your clients’ information, including payment history and contact details.

-

Payment Gateway Integration: You can integrate payment gateways like PayPal, Stripe, and others to receive payments directly from invoices.

-

Custom Branding: Customize your invoices with your business logo, colors, and branding to maintain a professional look.

-

Tax Calculations: Invoiless automatically calculates taxes based on your settings, ensuring accurate and compliant invoices.

Invoiless Reviews: Pros and Cons

Let’s take a closer look at the advantages and disadvantages of using Invoiless.

Pros

-

User-Friendly Interface: Invoiless is known for its simple and intuitive interface. Even beginners can start using it without a steep learning curve.

-

Affordable Pricing: Compared to other invoicing software, Invoiless offers affordable pricing plans, making it a good choice for startups and small businesses.

-

Customizable Templates: The customizable invoice templates allow businesses to create professional-looking invoices that reflect their branding.

-

Recurring Invoices: This feature is useful for businesses with clients on subscription models, as it saves time by automating the invoicing process.

-

Secure Payment Options: Invoiless integrates with popular payment gateways, allowing businesses to securely accept online payments.

Cons

-

Limited Advanced Features: While Invoiless offers essential invoicing features, it may lack advanced tools that larger businesses might require.

-

No Mobile App: Currently, Invoiless doesn’t offer a mobile app, which may be inconvenient for users who prefer managing invoices on the go.

-

Limited Reporting Tools: While Invoiless tracks invoices and payments, it doesn’t provide detailed financial reports, which could be a drawback for businesses that need advanced financial analytics.

How Does Invoiless Compare to Other Invoicing Tools?

To help you compare Invoiless to other invoicing software, we’ve created a quick comparison table with some popular alternatives:

| Feature | Invoiless | FreshBooks | QuickBooks |

|---|---|---|---|

| Easy to Use | Yes | Yes | Moderate |

| Customizable Templates | Yes | Yes | Yes |

| Recurring Invoices | Yes | Yes | Yes |

| Mobile App | No | Yes | Yes |

| Financial Reports | Basic | Advanced | Advanced |

| Price | Affordable | Expensive | Expensive |

Who Should Use Invoiless?

Invoiless is designed for small businesses, freelancers, and entrepreneurs who need an easy-to-use invoicing tool without the complexity and high costs of more advanced software. Here are some specific groups who can benefit from Invoiless:

-

Freelancers: Invoiless is ideal for freelancers who need to send simple invoices to clients and track payments easily.

-

Small Business Owners: Small businesses that need a straightforward invoicing solution will find Invoiless affordable and efficient.

-

Startups: New businesses that are just getting started can take advantage of Invoiless’ simple setup and affordable pricing.

-

Service Providers: Businesses that provide subscription-based services can benefit from the recurring invoice feature.

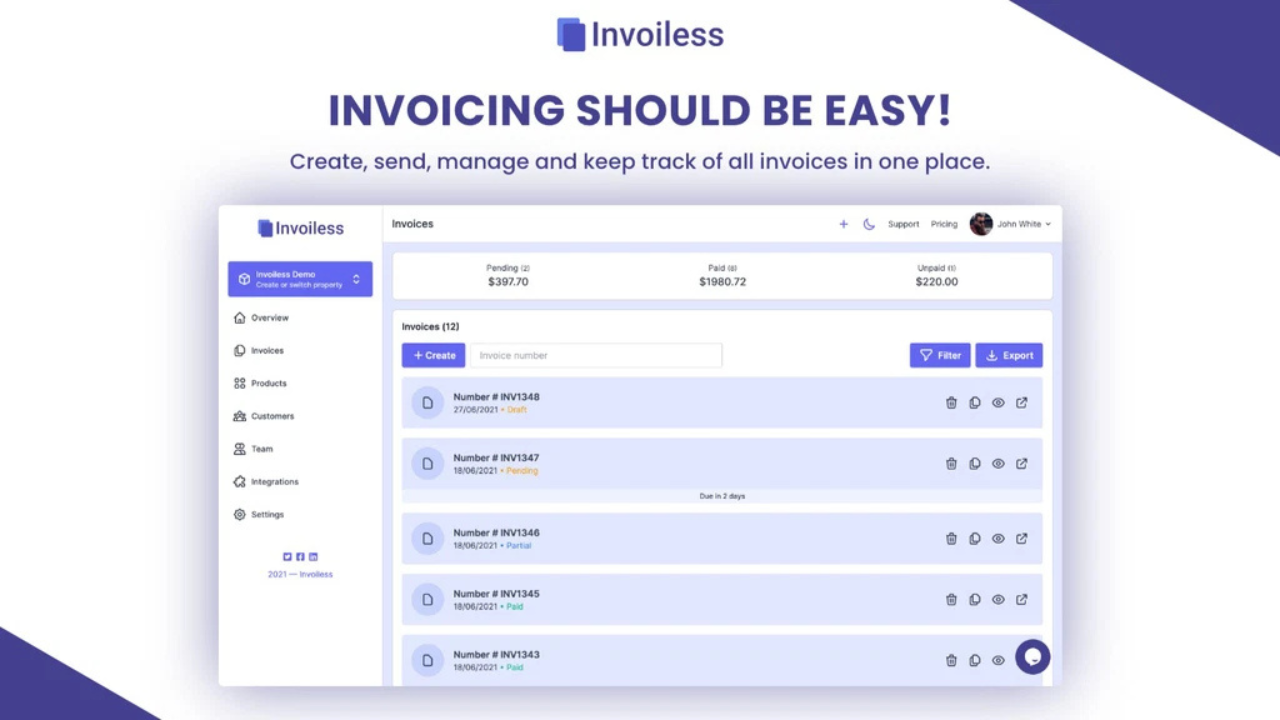

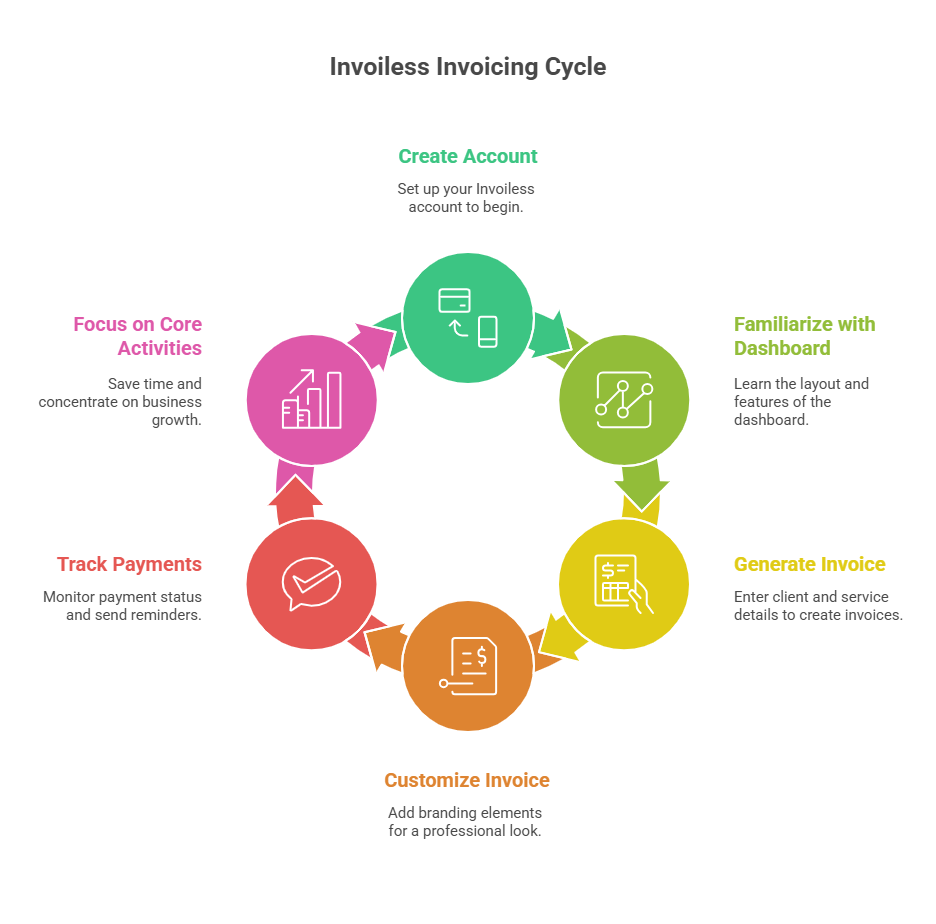

How to Use Invoiless for Efficient Invoicing

Using Invoiless is simple. Here’s a quick guide to help you get started:

-

Sign Up: Create an account on Invoiless by visiting the website. You’ll need to provide some basic business information.

-

Customize Your Profile: Upload your business logo, set up your tax rates, and add your preferred payment gateways.

-

Create an Invoice: Choose from customizable templates and add your client details, services/products, and prices.

-

Send the Invoice: Once you’re happy with the invoice, send it directly to your client via email. You can also download it as a PDF.

-

Track Payments: Monitor the status of your invoices. If a payment is overdue, Invoiless will send an automatic reminder to the client.

-

Generate Reports: Although Invoiless doesn’t provide advanced reports, you can still track payments and outstanding invoices with the built-in features.

Is Invoiless Worth the Investment?

Invoiless is a great option for small businesses and freelancers looking for an affordable and easy-to-use invoicing solution. Its straightforward features make it a perfect choice for those who don’t need complex reporting tools or advanced features.

For businesses just starting out or those with basic invoicing needs, Invoiless offers excellent value at an affordable price. However, if you need more advanced features like detailed financial reports or mobile access, you may want to consider other options like FreshBooks or QuickBooks.

FAQs About Invoiless

-

Is Invoiless Free? No, Invoiless offers a paid subscription model. However, it’s affordable compared to other invoicing software.

-

Can I Customize My Invoices in Invoiless? Yes, Invoiless provides customizable templates that you can adjust to match your business’s branding.

-

Does Invoiless Integrate with Payment Gateways? Yes, Invoiless supports integration with popular payment gateways like PayPal and Stripe.

-

Can I Set Up Recurring Invoices in Invoiless? Yes, Invoiless allows you to create recurring invoices for clients with subscription-based services.

-

Is There a Mobile App for Invoiless? Currently, Invoiless does not offer a mobile app, so you’ll need to manage your invoices through the web version.

Conclusion

Invoiless offers a simple, affordable, and user-friendly invoicing solution for small businesses and freelancers. With its customizable templates, automated reminders, and recurring invoice features, it can make invoicing easy and efficient. While it may not have the advanced features of larger platforms, Invoiless is perfect for users who need a straightforward tool to manage their invoices and payments.

If you’re looking for a simple, cost-effective invoicing tool, Invoiless is definitely worth considering. It offers good value for money and can help you stay on top of your business’s invoicing needs.

>>> Click if you want to buy the product.

Automation and analytics, our in-depth evaluations and comparisons help you make informed decisions, empowering you to streamline your workflow and confidently achieve your goals.

Quick Link

- About us

- Contact us

- Disclosure

- Privacy Policy

Newsletter

Subscribe our Latest Newsletter